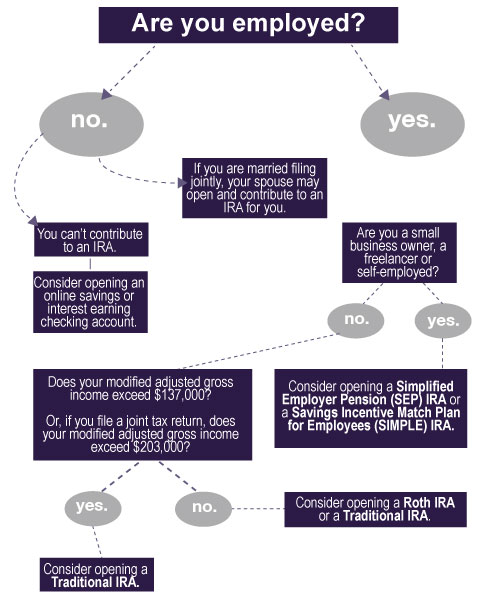

Dec 1, 2023Traditional IRAs. A traditional IRA is a way to save for retirement that gives you tax advantages. Contributions you make to a traditional IRA may be fully or partially deductible, depending on your filing status and income, and. Generally, amounts in your traditional IRA (including earnings and gains) are not taxed until you take a

The Difference Between Generative AI And Traditional AI: An Easy Explanation For Anyone

See Answer. Question: Which of the following statements about traditional IRAs is TRUE? A) Taxable investment income, such as interest, dividends, and capital gains, will qualify as compensation for the purpose of contributing to an IRA. B) Taxpayers may be able to reduce their tax liability by contributing to an IRA after the tax year has ended.

Source Image: chegg.com

Download Image

Which of these statements concerning Traditional IRAs is CORRECT? Earnings are taxable when withdrawn Rob has a benefit at work which enables him to defer his current receipt of income and have it paid at a later date, when he will probably be in a lower tax bracket.

Source Image: optimataxrelief.com

Download Image

The 80-20 Rule (aka Pareto Principle): What It Is, How It Works Which of the following statements concerning contributions to traditional IRAs is correct? (A) Contributions may be used to buy life insurance policies. (B) Contributions may be deductible or nondeductible. (C) Contributions may be commingled with a taxpayer’s other assets. (D) The maximum contribution is 25 percent of the taxpayer’s income.

Source Image: gijn.org

Download Image

Which Of These Statements Concerning Traditional Iras Is Correct

Which of the following statements concerning contributions to traditional IRAs is correct? (A) Contributions may be used to buy life insurance policies. (B) Contributions may be deductible or nondeductible. (C) Contributions may be commingled with a taxpayer’s other assets. (D) The maximum contribution is 25 percent of the taxpayer’s income. All of the following are exempt from the 10% tax penalty for early qualified plan withdrawals EXCEPT. upon distribution. Under a Traditional IRA, interest earned is taxed. income. Mike has inherited his father’s traditional IRA. As beneficiary, he will pay ____ taxes on any money withdrawn. 59 1/2. Erica is 35 years old and owns an IRA.

5 Must-See Films About Investigative Journalism from 2022 – Global Investigative Journalism Network

Study with Quizlet and memorize flashcards containing terms like which of these statements concerning Traditional IRAs is CORRECT? 1. earnings are not taxable when withdrawn 2. earnings are taxable when withdrawn 3. contributions are never tax-deductible 4. contributions are always made by the employer, an example of a tax-qualified retirement plan would be a(n) 1. equity compensation plan 2 What Is Personal Finance, and Why Is It Important?

:max_bytes(150000):strip_icc()/personalfinance_definition_final_0915-Final-977bed881e134785b4e75338d86dd463.jpg)

Source Image: investopedia.com

Download Image

Which IRA is right for you? The difference between Roth and Traditional – SouthPoint Financial Credit Union Study with Quizlet and memorize flashcards containing terms like which of these statements concerning Traditional IRAs is CORRECT? 1. earnings are not taxable when withdrawn 2. earnings are taxable when withdrawn 3. contributions are never tax-deductible 4. contributions are always made by the employer, an example of a tax-qualified retirement plan would be a(n) 1. equity compensation plan 2

Source Image: southpointfinancial.com

Download Image

The Difference Between Generative AI And Traditional AI: An Easy Explanation For Anyone Dec 1, 2023Traditional IRAs. A traditional IRA is a way to save for retirement that gives you tax advantages. Contributions you make to a traditional IRA may be fully or partially deductible, depending on your filing status and income, and. Generally, amounts in your traditional IRA (including earnings and gains) are not taxed until you take a

Source Image: forbes.com

Download Image

The 80-20 Rule (aka Pareto Principle): What It Is, How It Works Which of these statements concerning Traditional IRAs is CORRECT? Earnings are taxable when withdrawn Rob has a benefit at work which enables him to defer his current receipt of income and have it paid at a later date, when he will probably be in a lower tax bracket.

:max_bytes(150000):strip_icc()/Term-Definitions_80-20-rule-e0f7f05b70d5479d8d4f8fcfd6a5286b.jpg)

Source Image: investopedia.com

Download Image

Watch Bloomberg Markets: The Close 01/10/2023 – Bloomberg The correct statement concerning Traditional Individual Retirement Accounts (IRAs) is that ‘B) Earnings are taxable when withdrawn’. In a Traditional IRA, contributions are often tax-deductible depending on your income and tax-filing status but the withdrawals, during retirement, are generally taxed. Unlike 401(k) accounts which are usually

Source Image: bloomberg.com

Download Image

2024 banking industry outlook | Deloitte Insights Which of the following statements concerning contributions to traditional IRAs is correct? (A) Contributions may be used to buy life insurance policies. (B) Contributions may be deductible or nondeductible. (C) Contributions may be commingled with a taxpayer’s other assets. (D) The maximum contribution is 25 percent of the taxpayer’s income.

Source Image: www2.deloitte.com

Download Image

Thinking About an Early Retirement? Here’s What Executives Should Know All of the following are exempt from the 10% tax penalty for early qualified plan withdrawals EXCEPT. upon distribution. Under a Traditional IRA, interest earned is taxed. income. Mike has inherited his father’s traditional IRA. As beneficiary, he will pay ____ taxes on any money withdrawn. 59 1/2. Erica is 35 years old and owns an IRA.

Source Image: linkedin.com

Download Image

Which IRA is right for you? The difference between Roth and Traditional – SouthPoint Financial Credit Union

Thinking About an Early Retirement? Here’s What Executives Should Know See Answer. Question: Which of the following statements about traditional IRAs is TRUE? A) Taxable investment income, such as interest, dividends, and capital gains, will qualify as compensation for the purpose of contributing to an IRA. B) Taxpayers may be able to reduce their tax liability by contributing to an IRA after the tax year has ended.

The 80-20 Rule (aka Pareto Principle): What It Is, How It Works 2024 banking industry outlook | Deloitte Insights The correct statement concerning Traditional Individual Retirement Accounts (IRAs) is that ‘B) Earnings are taxable when withdrawn’. In a Traditional IRA, contributions are often tax-deductible depending on your income and tax-filing status but the withdrawals, during retirement, are generally taxed. Unlike 401(k) accounts which are usually